About the Journal

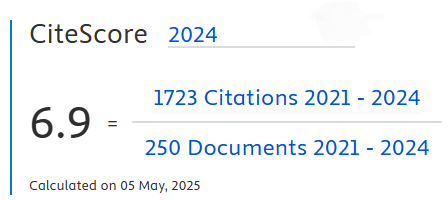

Title: International Journal of Interactive Multimedia and Artificial Intelligence (IJIMAI)

Edited by: Elena Verdú, Universidad Internacional de la Rioja (Spain)

Published by: Universidad Internacional de la Rioja (Spain)

ISSN: 1989-1660 |DOI: 10.9781/ijimai

Periodicity: quarterly

Content access policy: open access

Editors & Editorial Board | Scientific Committee | Reviewers of the 2024 issues

Subjects: AI theories, methodologies, systems, and architectures that integrate multiple technologies, as well as applications combining AI with interactive multimedia techniques

The International Journal of Interactive Multimedia and Artificial Intelligence (IJIMAI, ISSN 1989-1660) is a quarterly open-access journal that serves as an interdisciplinary forum for scientists and professionals to share research results and novel advances in artificial intelligence. The journal publishes contributions on AI theories, methodologies, systems, and architectures that integrate multiple technologies, as well as applications combining AI with interactive multimedia techniques.